how much taxes are taken out of a paycheck in ky

Amount taken out of an average biweekly paycheck. If you increase your contributions your paychecks will get smaller.

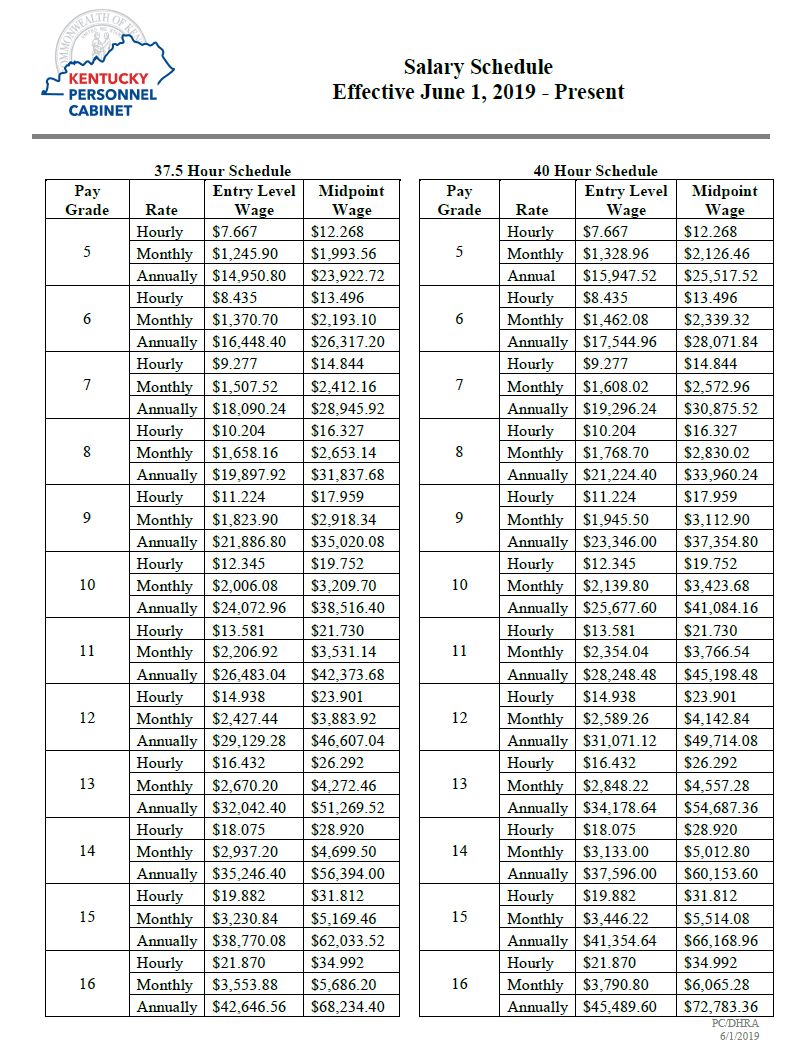

Paycheck Calculator Kentucky Ky Hourly Salary

Only the very last 1475 you earned would be taxed at.

. However making pre-tax contributions will also decrease the. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck.

For instance workers who make 3000 a year or less in taxable income pay state taxes at a rate of 2 percent while those who earn between 3000 and 4000 a year pay a marginal rate of 3 percent. Total income taxes paid. The amount of FICA tax is 153 of the employees gross pay.

This is because they have too much tax withheld from their paychecks. Yes Kentucky residents pay a flat rate for personal income tax. The average taxpayer gets a tax refund of about 2800 every year.

Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. This free easy to use payroll calculator will calculate your take home pay. You Should Never Say I Cant Afford That.

Using our Kentucky Salary Tax Calculator. Amount taken out of an average biweekly paycheck. Amount taken out of an average biweekly paycheck.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. For 2022 employees will pay 62 in Social Security on the first 147000 of wages. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

Amount taken out of an average biweekly paycheck. These amounts are paid by both employees and employers. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

Medicare tax is 145 of your wages and Social Security is 62. Amount taken out of an average biweekly paycheck. FICA taxes consist of Social Security and Medicare taxes.

Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki. However they dont include all taxes related to payroll. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Half of the total 765 is withheld from the employees paycheck and half is paid by the employer. Where Do Americans Get Their Financial Advice. 7031 Koll Center Pkwy Pleasanton CA 94566.

How much taxes are withheld from my paycheck. 0765 for a total of 11475. How much you pay in federal income taxes depends on the information you filled out on your Form W-4.

Kentucky Salary Paycheck Calculator. Supports hourly salary income and multiple pay frequencies. In effect taxpayers who get refunds are giving the IRS an interest-free loan of their money.

Total income taxes paid. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Employers also have to pay a matching 62 tax up to the wage limit. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Switch to Kentucky hourly calculator.

Workers with incomes between 4000 and 5000 pay a 4 percent tax rate while those who earn between 5000 and 8000 pay taxes at a 5 percent rate. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. If your salary is over 200000 your earnings in excess of 200000 are subject to an additional 09 in Medicare tax.

For a single filer the first 9875 you earn is taxed at 10. FICA taxes are commonly called the payroll tax.

Ltr Notarized Or Stamped Love Quotes For Him Romantic Lettering Love Quotes For Him

2022 Hologram Credit Card Style Business Card Template Psd Etsy Business Card Template Psd Business Card Template Beautiful Business Card

Contribution Rates Kentucky Public Pensions Authority

How To Pay Less Taxes Legally In 2021 Financial Motivation Investing Money Personal Finance Bloggers

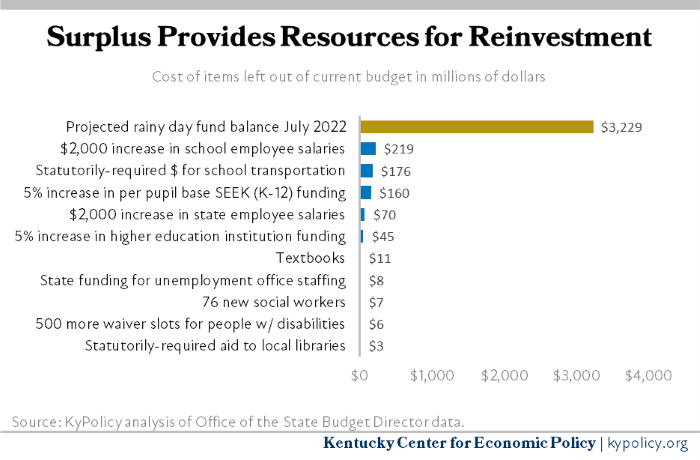

Unprecedented Surplus Presents Opportunity To Both Reinvest In Kentucky S Budget And Build Rainy Day Fund Kentucky Center For Economic Policy

Occupational Tax Campbell County Kentucky

Yes You Re In The Right Place If You Need Any Fake Docs Passports Id Cards And Lots More To Get The Ad State Farm Insurance State Farm Home Insurance Quotes

Payroll Software Solution For Kentucky Small Business

State Of Kentucky Payroll Calendar 2022 Payroll Calendar

Kentucky Wage Calculator Minimum Wage Org

Monthly Budget Planner Printable Monthly Budget Printable Pdf Monthly Budget Template Printable Budget Worksheet Budget Planner Bundle Maandelijkse Budgetplanner Budget Werkbladen Budget Planner

Taxidermist Salary In Louisville Ky Comparably

Kentucky Paycheck Calculator Smartasset

Fanmats Ncaa Eastern Kentucky University Maroon 2 Ft X 3 Ft Area Rug 453 The Home Depot In 2021 Eastern Kentucky University Kentucky Team Colors

Kentucky Tax Relief Information Larson Tax Relief

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

Kentucky Eliminates Composite Returns For Nonresident Individuals Cincinnati Ohio Cpas Advisors

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

8 Sample Payroll Checks Simple Salary Slip Payroll Checks Quickbooks Payroll Payroll Template